Thursday 3rd April, 2025

Fed

Interest Rate Definition - Stock Trader Terms

The

United States Federal Reserve, commonly known as the Fed, plays a

crucial role in shaping the economic landscape of the country through

its control of interest rates. As the central bank of the United

States, the Fed's primary mandate is to promote maximum employment,

stable prices, and moderate long-term interest rates. One of the most

influential tools at the Fed's disposal is its ability to set the

federal funds rate, which is the interest rate at which banks lend to

each other overnight. Changes in this rate have far-reaching

implications for the economy, affecting everything from consumer loans

and mortgages to business investments and international financial

markets. The

United States Federal Reserve, commonly known as the Fed, plays a

crucial role in shaping the economic landscape of the country through

its control of interest rates. As the central bank of the United

States, the Fed's primary mandate is to promote maximum employment,

stable prices, and moderate long-term interest rates. One of the most

influential tools at the Fed's disposal is its ability to set the

federal funds rate, which is the interest rate at which banks lend to

each other overnight. Changes in this rate have far-reaching

implications for the economy, affecting everything from consumer loans

and mortgages to business investments and international financial

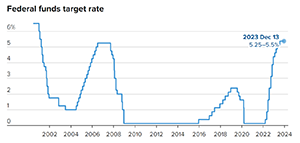

markets.The federal funds rate is set by the Federal Open Market Committee (FOMC), which meets regularly to assess economic conditions and determine the appropriate stance of monetary policy. When the economy is growing too quickly and inflationary pressures are building, the Fed may decide to raise interest rates to cool down economic activity. Conversely, when the economy is in a downturn or experiencing weak growth, the Fed may lower interest rates to stimulate borrowing, spending, and investment. The relationship between the Fed's interest rate decisions and the broader economy is complex and multifaceted. Higher interest rates tend to increase the cost of borrowing, which can dampen consumer spending and business investment. This can lead to slower economic growth and help control inflation by reducing demand. On the other hand, lower interest rates make borrowing cheaper, encouraging consumers to spend and businesses to invest, which can boost economic activity and job creation. Interest rate changes also impact the financial markets. When the Fed raises rates, bond prices typically fall, and yields rise, as investors demand higher returns to compensate for the increased cost of borrowing. Stock markets can also be affected, as higher interest rates can reduce corporate profits and make equities less attractive relative to fixed-income investments. Conversely, when the Fed lowers rates, bond prices generally rise, yields fall, and stock markets may benefit from the prospect of cheaper borrowing costs and improved economic prospects. The Fed's interest rate decisions are closely watched by both domestic and international investors, as they can influence global financial conditions. Changes in U.S. interest rates can affect exchange rates, capital flows, and the economic performance of other countries. For example, higher U.S. interest rates can attract foreign capital, leading to a stronger dollar and putting pressure on other currencies. This can impact global trade dynamics, particularly for countries with significant trade relationships with the United States. In addition to the federal funds rate, the Fed uses other tools to influence monetary policy, including open market operations, the discount rate, and reserve requirements. Open market operations involve the buying and selling of government securities to regulate the supply of money in the economy. The discount rate is the interest rate the Fed charges banks for short-term loans, while reserve requirements dictate the amount of funds banks must hold in reserve against deposits. These tools work in conjunction with the federal funds rate to achieve the Fed's monetary policy objectives. The Fed's interest rate policy has evolved over time in response to changing economic conditions and challenges. During the financial crisis of 2007-2008, the Fed lowered interest rates to near zero and implemented unconventional measures such as quantitative easing to support the economy. More recently, the Fed has had to navigate the economic disruptions caused by the COVID-19 pandemic, once again lowering rates to support recovery efforts and using a range of tools to ensure financial stability. Fed's control of interest rates is a powerful lever for guiding the U.S. economy. By adjusting the federal funds rate, the Fed influences borrowing costs, consumer spending, business investment, and overall economic activity. These decisions have wide-ranging implications for financial markets, the global economy, and the day-to-day lives of American consumers and businesses. As such, the Fed's interest rate policy remains a critical aspect of economic management, closely scrutinized by economists, policymakers, and investors worldwide. Bank interest rates are a fundamental aspect of the financial system, influencing borrowing, saving, and overall economic activity. These rates, determined by both market conditions and regulatory policies, dictate the cost of borrowing money through loans and mortgages, as well as the returns earned on savings accounts and other deposit instruments. When banks offer higher interest rates on savings, it encourages individuals to save more, which can lead to increased capital availability for loans and investments. Conversely, lower interest rates reduce the cost of borrowing, stimulating consumer spending and business investments by making credit more affordable. The interplay of these rates affects everything from personal financial planning to corporate expansion, and is crucial in shaping the broader economic environment. |

Copyright © 2000-2024, Ashkon Software LLC

Privacy Policy | Refund Policy

| Disclaimer